Ultra Trend

When there are no👻patterns, it means insiders are not trading. They're waiting. Waiting for some unpredictable event to occur. So, the market is not disturbed by their volatile actions. Therefore, the market's 'ultra-trend' is revealed. An amazing discovery🤯

— bottom1 (@Bottom1Frankdux) October 16, 2024

Bimini Road uncovers a striking insight: the absence of Ghost Patterns reveals the market's true ultra-trend direction. When no Ghost Patterns appear, it signals that insiders aren’t trading, indicating they’re waiting for something significant to happen.

Without the influence of insider transactions, the market is free to follow the ultra-trend.

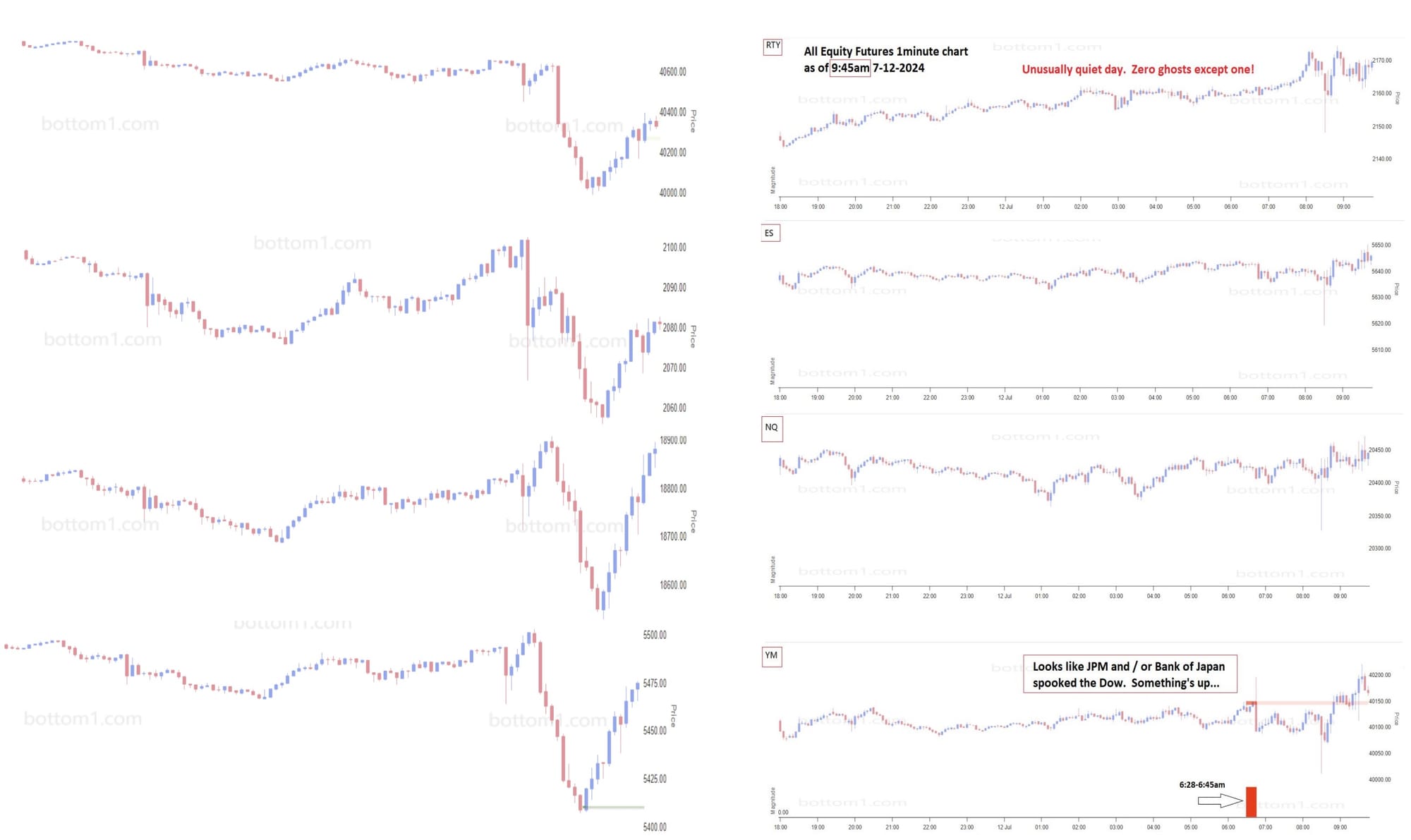

The absence of Ghost Patterns highlights two key points: a) Insider actions have a profound impact on market movements, and b) In the absence of insider activity, the market follows the dominant ultra-trend. This lack of “noise” unveils a highly valuable and timely indicator: the true direction of the market. Below are some examples of no Ghost Pattern days taken from tweets. As you can see across the entire stock market, the trend is up and if there’s a large dip, it’s bought indicating an “up” ultra-trend.

Join Us in Shaping the Future

We are seeking visionary investors to help build one of Atlanta’s most revolutionary FinTech startups. With your support, we will lay the foundation for industry-changing products that redefine how people interact with money.

Interested in being part of this journey? Contact us here. Together, we can reshape the financial landscape.