Anatomy of a Ghost Pattern

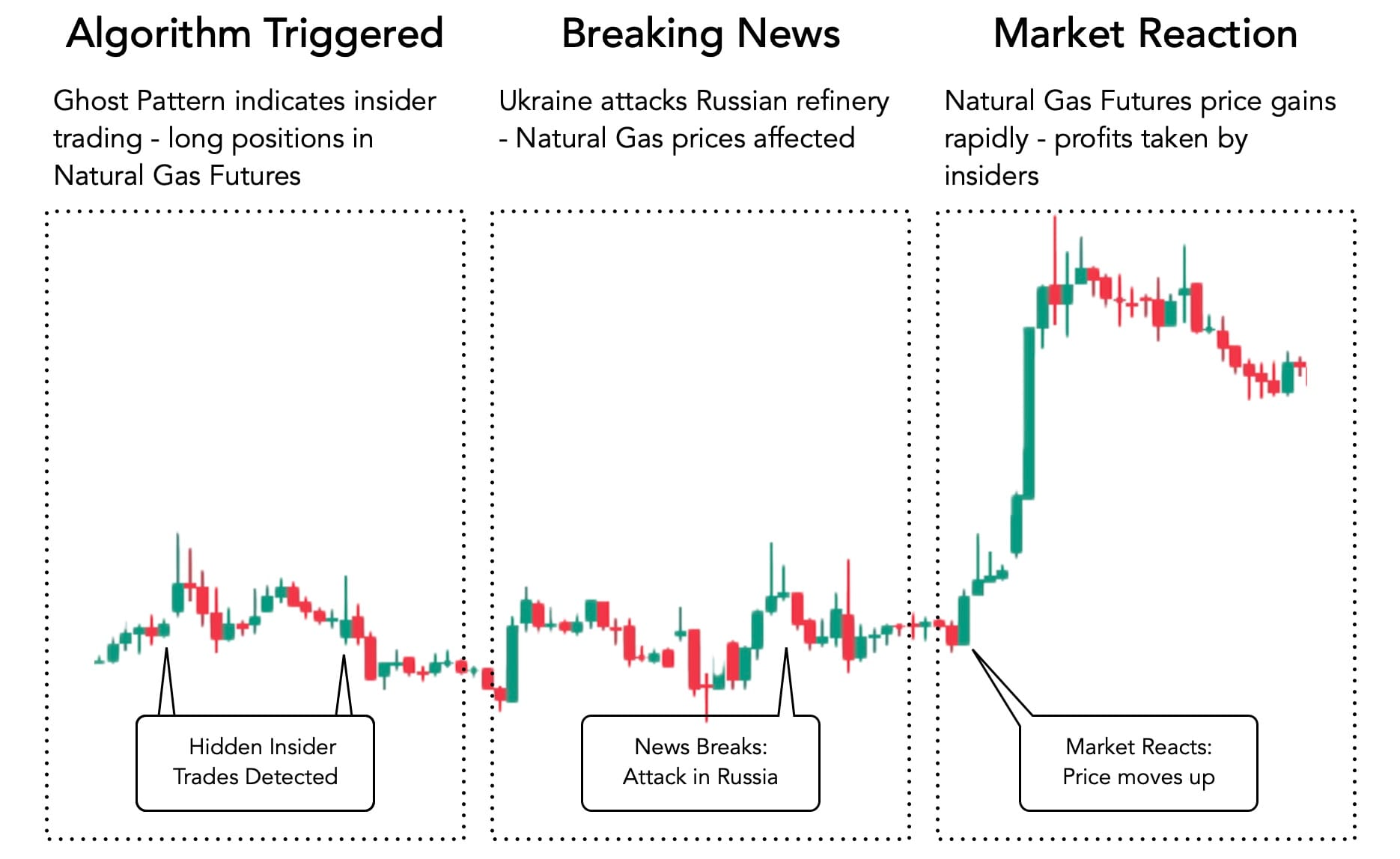

Bimini Road’s algorithm has uncovered a unique pattern in stock market data known as a Ghost Pattern. This pattern predicts market movements by identifying large inflows and outflows of money by insiders in particular stocks before the price changes occur.

Here’s how the Ghost Pattern works:

(a). The algorithm identifies significant insider trades in a particular stock and tracks whether those trades are buys or sells.

(b). Bimini Road then monitors the pattern until the insider activity halts, which can last for months, weeks, days, or even hours, depending on whether the chart is daily or intraday.

(c). Once an external event is announced on major news or social media outlets, the market is impacted and the stock price moves in the direction previously indicated by the Ghost Pattern. For example, if insiders were buying the stock, the price will rise. This movement often happens swiftly, triggered by breaking news from sources like Bloomberg, FT, Benzinga, CNBC, SeekingAlpha, or ZeroHedge.

Join Us in Shaping the Future

We are seeking visionary investors to help build one of Atlanta’s most revolutionary FinTech startups. With your support, we will lay the foundation for industry-changing products that redefine how people interact with money.

Interested in being part of this journey? Contact us here. Together, we can reshape the financial landscape.